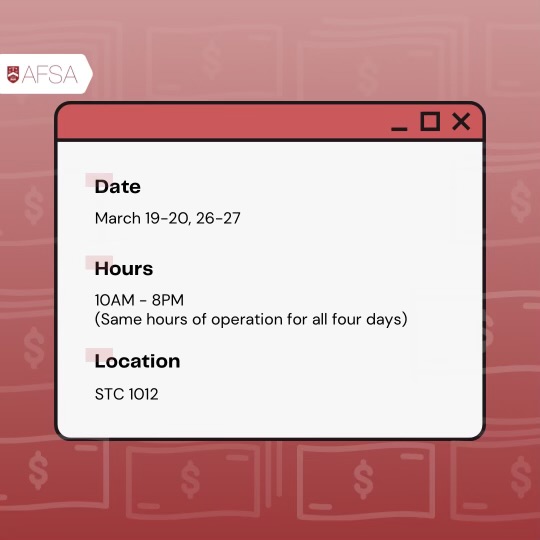

The Accounting and Finance Student Association’s (AFSA) annual Tax Clinic will be preparing returns at no cost for community members on March 19th, 20th, 26th and 27th.

The clinic operates as part of the Community Volunteer Income Tax Program with the Canada Revenue Agency (CRA). Clinic volunteers have co-op and full-time experience in tax — with one preparer volunteering for the ninth year in a row.

The Clinic’s volunteers have been preparing tax returns for low-income individuals and families for over 14 years at no cost. This year, Tax Clinic leaders Ben Ma and Eric Fong announced that eligibility requirements have expanded to include all students regardless of income level. The Clinic is open to all community residents, including students from UW, Wilfrid Laurier University and Conestoga College.

In 2012, approximately 400 returns were prepared over three days, and seven years later, the Clinic grew to prepare over 1200 returns over four days. This year, the Clinic expects to complete a similar number of returns. Additionally, it is ready to prepare the previous year’s returns based on the possibility that many students may not have filed their tax returns the past couple of years due to the

pandemic.

Volunteers attend a two-day training session that is run by two School of Accounting and Finance alumni, Ben Ma, CPA, CFA and Eric Fong, CPA, CA, CPA (Illinois), who have been leading the Tax Clinic since 2013 and 2014, respectively. Each year, the training session is updated to include pertinent information regarding preparation of the returns. This year, the training included information about the simplified work-from-home deductions for individuals who worked from home in 2021.

The Clinic regularly sees returning clients, with many students using the Clinic throughout their undergraduate years. “Returning clients often praise the convenience of the Clinic, dedicated volunteers with training catered for their particular situations and the reliability of our experienced volunteers who worked in tax,” Ma and Fong explained in an emailed statement.

The 2020 Tax Clinic was cancelled due to the first COVID-19 lockdown, and the 2021 Tax Clinic was modified to run virtually in a drop-off format. With COVID-19 restrictions lifting, the Tax Clinic is running in-person for the first time in two years in the Science Teaching Complex (STC), where multiple classrooms will be used to maintain social distancing.

For more information about the Tax Clinic and eligibility, please visit uwafsa.ca/taxclinic.