Almost $1 million in workplace safety payments were made to UW employees between 2017 and 2018.

UW employees received $910,185 from Ontario’s Workplace Safety Insurance Board, according to the organization’s own Safety Check website.

Over $470,000 — just above 50 per cent of those payments, consisted of “other” payments incurred in 2017.

“Other” workplace safety payments consist of a wide variety of benefits, such as future economic losses, non-economic losses, survivor benefits, and worker’s pension benefits, among other payments.

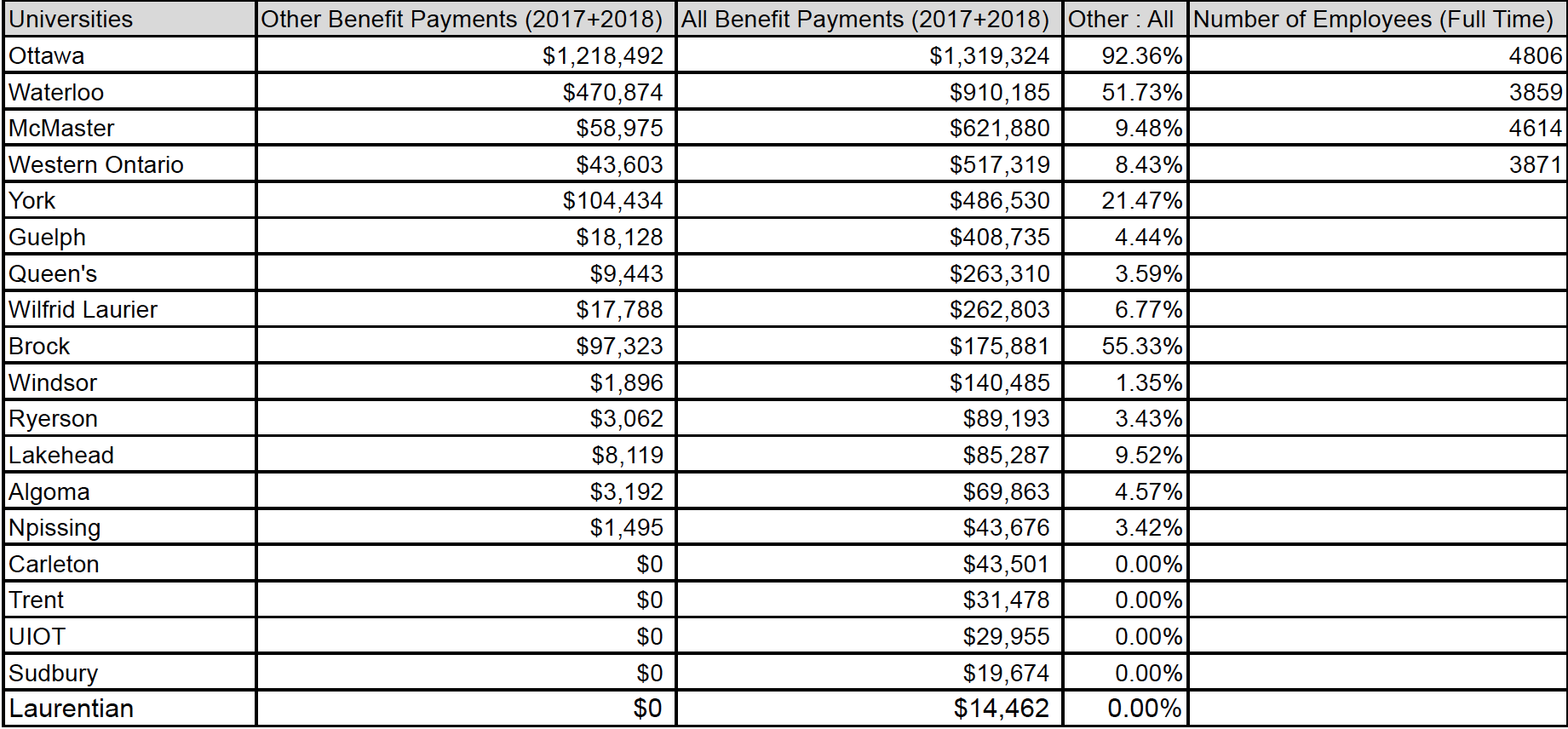

UW exceeded all Ontario universities in 2017 and 2018 combined in terms of total workplace safety payments and “other” payments, except for the University of Ottawa.

The University of Ottawa received over $1.2 million in “other” payments in 2018, which made up over 90 per cent of their total benefit in 2017 and 2018 combined.

According to the Workplace Safety Insurance Board’ s (WSIB) Safety Check website, 41 per cent of lost-time injuries incurred between 2012 and 2018 consisted of strains and sprains, 27 per cent of injuries resulted from structures (such as floors and walkways), and 20 per cent of injuries affected UW’s cleaners. Further details of where UW’s benefit payments went and their relation to the lost-time injury statistics were undisclosed for privacy reasons.

According to Matthew Grant, UW Media Relations Director, the benefit payments were not paid directly by UW, but through WSIB, an independent trust arm of the Ontario government.

UW pays premiums to WSIB on a regular basis, such that if an incident does occur, the WSIB has enough funds to pay back its clients for potential losses.

“Premiums are based on whether the insurer requires to operate its business and cover the cost of claims,” said Grant. “Each employer pays a premium based on their insurable earnings, and all premiums go to WSIB, which pays the benefits out of that pool of money.”

Grant also stated that UW pays its premiums as part of a benefit group.

Premiums from each benefit group are based on their industry rate, meaning different groups pay different amounts of premiums. In UW’s case, its benefit group mostly consists of post-secondary institutions.

Martin Nguyen, the WSIB’s Public Affairs Communications Coordinator, said that the rise in UW’s benefit payments did not correlate with an increase in workplace safety violations.

“An increase in payments does not necessarily correlate with an increase in injuries,” said Nguyen. “For example, although, as [Imprint] mentioned, benefit payments were higher in 2017/2018 than 2015/2016, the number of allowed claims was actually lower in 2017/2018 than 2015/2016.”

Grant also reassured that despite the sharp increase in other payments, UW has continued to ensure a safe workplace environment for its employees.

“The performance of any member of a benefit group in WSIB is reflected in the premiums a member pays,” Grant said. “As in other insurance programs, poorer safety performance would lead to higher premiums and better safety performance would lead to lower premiums. I can confirm that between 2015 and 2018 our annual premium per $100,000 of payroll—how our premiums are calculated—increased by two per cent for the benefit group, and that the university received annual rebates on premiums from WSIB as a result of good claims performance.”

To clarify, rebates are discounts on premiums for responsible insurance clients.

Imprint got contacted The Fulcrum, the student newspaper at the University of Ottawa, about their benefit payment statistics.