I would like to see the day when I don’t need to carry cash, credit cards or any form of government-issued currency.

Instead, I’d just walk into the grocery store with my phone and pay for my groceries using my digital wallet. We keep on calling this the digital age, yet we still depend on physical cash for a lot of things in our lives. Although we already have the concept of digital banking and tap our cards to pay for goods and services, nevertheless such banking cards are infamous for charging high-interest rates when you don’t pay back in a predetermined period of time.

However, since Bitcoin was introduced back in the year 2009 by Satoshi Nakamoto, hence the first implementation of ‘cryptocurrency’, I felt that it was the initial step towards fully digitizing money. Let me start by giving a 10,000-foot view of what cryptocurrency, and bitcoin itself, is.

According to Investopedia, cryptocurrency is defined as a form of virtual currency that is secured with cryptography, making it difficult to counterfeit. These cryptocurrencies are then supported by a technology known as the ‘blockchain’, a digital ledger publicly available for anyone to view. The blockchain acts as the key to bitcoin, keeping track of all the transactions made.

Bitcoin is just one form of cryptocurrency. As an analogy, think of our mobile phones as blueprints for some handy device used for talking and texting—an iPhone is just another form or brand of this concept of mobile phones. While a bitcoin somewhat sounds like a loonie or toonie, it is not itself a physical coin; rather, it purely exists in its digital form.

To give you a better idea of what a Bitcoin is, imagine a new and made-up continent called the “Cryptopia.” As we would know, if you are interested in travelling to this continent you would have to exchange your money for the currency accepted in Cryptopia—just like any other country’s government-issued currency.

Say you arrived at the airport of Bitland—another made-up ‘Cryptopian’ country—ready to exchange your money for Bitcoins. When you do so, they do not actually give you any physical paper that shows some value, nor do they give you credit cards. Instead, they hand you a small device, almost like a smartphone and tell you that this device is all you need to pay for anything in Cryptopia, and such money is called the ‘cryptocurrency’.

The core difference between regular physical money and cryptocurrency is that cryptocurrency is decentralized, beyond the control of banks, and is immune to any sort of inflation, at least for the time being.

The reason that I feel Bitcoin, or any other form of cryptocurrency, has a slight edge over regular money is because it is backed by cryptography—a process converting any data into an obscure and secure message that can be converted back to its original form using specialized techniques. Hence, it is very hard to counterfeit, and most transactions made are also public and permanently etched into the ledger.

By public, it doesn’t mean that each transaction has your confidential information revealed, but it is instead done in a fully anonymous manner. However, this is a double-edged sword. Being too public can also make it easy to trace it back to you, the owner. There are certainly ways to protect yourself from this, but these details will not be provided here since I am not a full expert on the matter myself. But at least this openness is what makes cryptocurrency interesting and free from a single entity’s control.

Reiterating the fact, Bitcoin is a huge, stable network made up of the individual contributions of a large group of people known as “Bitcoin Miners” scattered across the world. In this way, nobody has a say on how the value increases or decreases, though you will still be taxed in case you decide to sell your Bitcoins for cash.

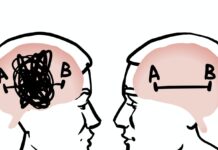

Before you begin investing in Bitcoin, I urge you to learn the ABC’s of cryptocurrency and proceed at your own risk. You should be ready to lose all your money if you decide to invest in Bitcoin since it is very volatile and keeps rising and dropping unpredictably. Moving on, let’s talk about why Bitcoin prices are so ridiculously high.

The total number of Bitcoins ever to be available in the entire world is 21 million. Currently, there are only 2,331,325.0 bitcoins left to be mined. That said, as the number keeps decreasing, its value will keep increasing because people would like to pay just about anything and everything to acquire some Bitcoins. It is important to note that this is only one answer to the question about the price of bitcoin—there are several other economic reasons involving the laws of supply and demand.

The final question is: “Would I invest in Bitcoins myself, or just stick to the same routine of waiting in line at the bank for hours just so someone can greet me and offer a new credit card with the old trick of paying now to obtain a 15 per cent discount for the card fee later?” The answer might not be straightforward.

As I stated in the beginning, I would like to see the day where I could buy a shirt worth 0.001 Bitcoins. However, not all countries are ready to accept Bitcoins as legal tender—for instance, you can’t pay student loans with Bitcoins at the moment.

It’s not a bad idea to start investing in Bitcoin today, since all you’re doing is spending your own money on a platform like CoinBase or other computing resources if you’re a Bitcoin miner and are trying to obtain some Bitcoins for yourself. Who knows, maybe one day the Bitcoin that you purchased after reading this article can buy you a brand-new luxury villa or a private jet.